If you haven’t been hiding under a rock, you’ve probably heard about the recent turmoil in the market as the Dow Jones Industrial Average suffered its largest one day point drop in history, following some less severe drops in the preceding days. If you were unable to resist the temptation to take a look at your account balances, you likely noticed a pretty significant difference in ending account balance compared to a week ago. So what does this mean to you, and is there anything you should do about it?

The short answer for the average investor is “nothing” and “no”, respectively, but let’s talk about why. The Dow Jones did suffer it’s largest one day point loss, but the more important measurement is the percentage drop. Since the Dow has grown so much in recent history, reaching and briefly surpassing the 26,000 point mark, a relatively small percentage change results in a seemingly large increase or decrease in points. The drop we just witnessed was not a small drop, but if we go by percentage change, it wasn’t even in the top 20 ranking of largest decreases in a single day. In short, by choosing to report based on the decrease in terms of points vs. percentages, the media was simply looking to turn a relatively newsworthy event into an extremely newsworthy event.

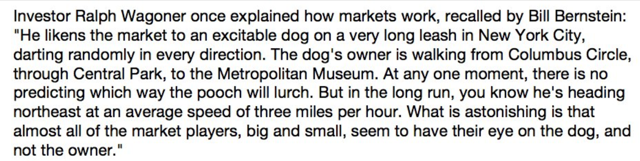

The bottom line, however, is that market turbulence should be expected from time to time. We have become spoiled with a long stretch of almost uninterrupted growth, and that makes the sting of a sudden drop more painful. Assuming your portfolio is appropriate for where you are in your investment lifecycle, the ups and downs of the market should not have a lasting effect on the long term success of your plan.

Ride out the wave and stay the course. This is just a reality of investing in the equity markets.