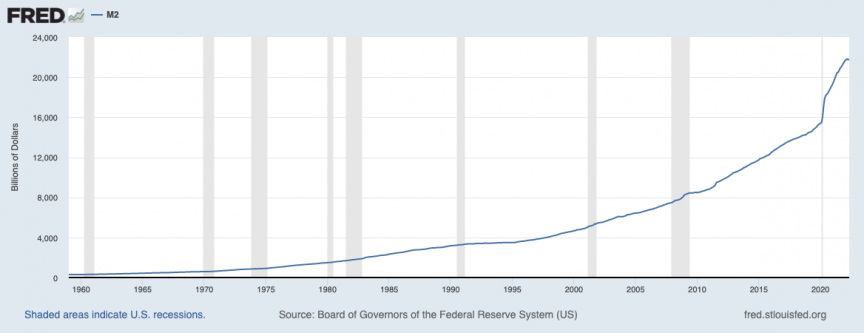

I can only imagine how difficult your week has been waiting for this Part II to come out! The suspense is over and here is where my focus is aimed…Short Answer: THERE IS A LOT OF MONEY OUT THERE! Long Answer: I’ve been listening to many anecdotal stories from friends and clients alike that range from art auctions on cruise ships to lake houses being bought with all cash. The common thread among them all reinforces the reality that THERE IS A LOT OF MONEY OUT THERE! The Global Financial Crisis in 2008 rushed in an era of extremely low interest rates and an ongoing increase in the money supply. In trying to keep it as simple as possible, the money supply is the amount of money out there that can be easily accessed to buy stuff. Your home equity wouldn’t be included in the money supply since you can’t really get access to it very quickly. You can’t bring your front door to the grocery store and swap it for a gallon of milk although that would be funny to watch. Now there are different variations of money supply, but one of the appropriate ones to use is what is called M2. M2 is the total value (in the United States only) of all currency, checking accounts, savings accounts and money market account type deposits. Here is the chart of the M2 money supply going back to 1960. Does something look funny about this chart?  As you can see, the line is always moving upwards, then Covid happened. Look at the dramatic rise in the amount of money that has only just recently started to see a teeny tiny decrease. This increase is impacted by government deficits, low interest rates and the federal reserve increasing its balance sheet to help promote economic growth during the shutdowns, and many other reasons. The real-time result is rapid price inflation. When I learned economics we mainly focused on inflation meaning more money. The headlines/government focus on inflation meaning things costing more money. For the past twenty years, prices have only risen very slightly year to year which has made it very easy to say there has been very little inflation. Now, not only are the goods and services we need sky rocketing in price, the amount of money has also sky rocketed creating a very technically termed double whammy! So what do we do in these, ahem, unprecedented times? You look for opportunities. When you are living in the storm, it can be easy to think the storm will never end. However, over time, prices will stabilize, inflation (no matter how you define it) will subside, and the engine that is capitalism will find equilibrium again. In some cases this balance is reached very quickly and your window to act or find opportunities is brief and short lived. In other periods of history, that window has remained open for much longer. The important take away is to look past tomorrow, take advantage of opportunities that exist today. Then tonight, for fun, take your kitchen sink to the nearest bar and see if you can’t swap it for a round of drinks for all your friends. Happy Friday!

As you can see, the line is always moving upwards, then Covid happened. Look at the dramatic rise in the amount of money that has only just recently started to see a teeny tiny decrease. This increase is impacted by government deficits, low interest rates and the federal reserve increasing its balance sheet to help promote economic growth during the shutdowns, and many other reasons. The real-time result is rapid price inflation. When I learned economics we mainly focused on inflation meaning more money. The headlines/government focus on inflation meaning things costing more money. For the past twenty years, prices have only risen very slightly year to year which has made it very easy to say there has been very little inflation. Now, not only are the goods and services we need sky rocketing in price, the amount of money has also sky rocketed creating a very technically termed double whammy! So what do we do in these, ahem, unprecedented times? You look for opportunities. When you are living in the storm, it can be easy to think the storm will never end. However, over time, prices will stabilize, inflation (no matter how you define it) will subside, and the engine that is capitalism will find equilibrium again. In some cases this balance is reached very quickly and your window to act or find opportunities is brief and short lived. In other periods of history, that window has remained open for much longer. The important take away is to look past tomorrow, take advantage of opportunities that exist today. Then tonight, for fun, take your kitchen sink to the nearest bar and see if you can’t swap it for a round of drinks for all your friends. Happy Friday!